Navigating health insurance can often feel like a daunting task,especially when it comes to understanding how deductibles apply to office visits. For many,the complexities of insurance terminology adn varying plan structures can lead to confusion and uncertainty,notably when it comes time to seek medical care. Whether you’re a seasoned policyholder or new to the world of health insurance, understanding your deductible’s role in office visits is crucial for managing your healthcare expenses effectively. This article aims to shed light on whether a deductible applies to these visits, exploring key factors that influence your out-of-pocket costs. By providing crucial insights into this often-overlooked aspect of health insurance, we hope to empower you with the knowledge you need to make informed decisions about your healthcare. Join us as we delve into the intricacies of deductibles and office visits, helping you navigate your health plan with greater confidence and clarity.

Understanding the Role of Deductibles in Office Visits for Your healthcare Costs

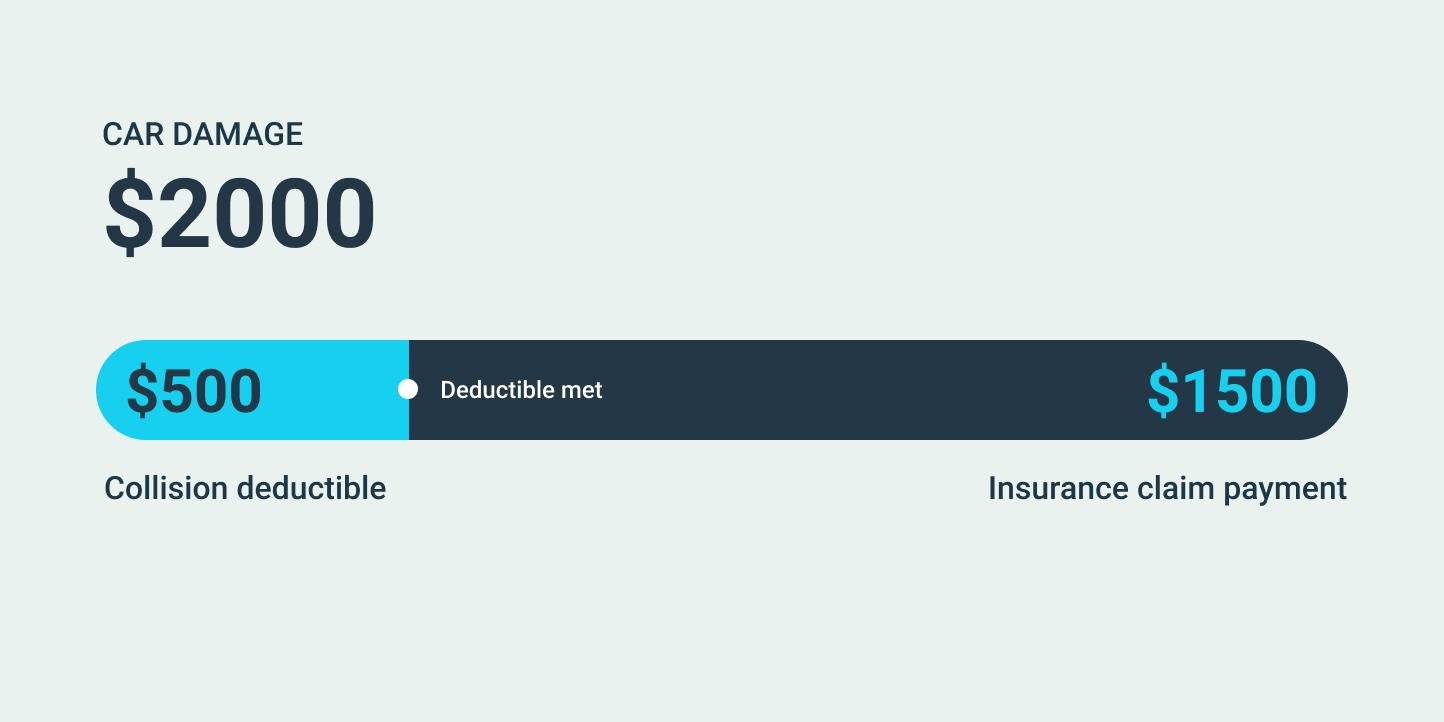

When navigating the complexities of your healthcare costs, understanding deductibles is crucial, especially for office visits. A deductible is the amount you need to pay out-of-pocket for healthcare services before your insurance begins to cover the costs. This can lead to confusion, particularly in determining what expenses apply to this threshold. Here are some key points to consider:

- Types of Plans: Some health insurance plans have separate deductibles for different services,like hospital stays versus office visits.

- Annual Limit: Each year, your insurance will reset your deductible, so it’s essential to track your expenses as you approach your limit.

- Preventive Services: Many plans waive the deductible for preventive office visits, such as annual check-ups or vaccinations, meaning you won’t pay out-of-pocket for these services.

- Costs during the Year: If you require multiple office visits throughout the year, consider how quickly you’ll meet your deductible and how that affects your overall budget.

To illustrate how deductibles work specifically for office visits, you might find this simple table useful:

| Plan Type | Deductible Amount | Office Visit Cost (after deductible) |

|---|---|---|

| Basic Plan | $1,000 | $30 copay |

| Comprehensive Plan | $500 | $20 copay |

| High Deductible Plan | $2,500 | 20% coinsurance after deductible |

As you navigate your healthcare costs, keep in mind that understanding your deductible can impact how you approach office visits and overall expenditures throughout the year. Being informed not only helps you manage your finances but also enhances your healthcare experience when visiting providers.

Navigating Your Insurance: Key Recommendations for Managing Deductible Impacts on Office Visits

When it comes to office visits and insurance deductibles, understanding your policy can make a meaningful difference in your overall healthcare expenses. Here are some key recommendations to help you manage the impact of deductibles:

- Know Your Deductible Amount: Familiarize yourself with the specifics of your deductible. This is the amount you’ll need to pay out-of-pocket before your insurance kicks in.most policies have individual and family deductibles, so check which one applies to you.

- Schedule Preventive Visits: Many insurance plans cover preventive services without applying a deductible. This includes annual check-ups, vaccinations, and screening tests. Take advantage of these to maintain your health without extra costs.

- Utilize In-Network Providers: Choosing providers within your insurance network often leads to lower costs. Ensure you confirm your office visits are covered at reduced rates by opting for in-network physicians.

- Plan Visits Wisely: If you have a couple of symptoms that need attention, consider scheduling them together during one visit. This strategy may keep you under your deductible cap, saving you money in the long run.

- Keep Track of Your Payments: Monitor your billing statements for accuracy.Sometimes mistakes can occur, and it’s essential to rectify any inaccuracies related to your deductible payments.

Additionally,utilizing a health savings account (HSA) or flexible spending account (FSA) can provide financial relief. These accounts allow you to pay for medical expenses with pre-tax dollars, effectively reducing your overall out-of-pocket costs. The following table summarizes some notable features:

| account Type | Tax Advantage | Contribution Limit (2023) |

|---|---|---|

| Health Savings Account (HSA) | Funds grow tax-free, tax-free withdrawals for medical expenses | $3,850 (individual) $7,750 (family) |

| Flexible Spending Account (FSA) | Tax-free contributions, tax-free withdrawals for medical expenses | $3,050 (individual) |

Following these strategies will help you navigate the complexities of insurance deductibles while ensuring that your health remains a top priority. At Gezify, we encourage you to stay informed and proactive about your healthcare choices.

Navigating the complexities of healthcare costs can be challenging, especially when it comes to understanding how deductibles impact office visits. We hope this article has provided you with valuable insights and clarity on this often-confusing topic.Remember, being informed is a crucial step in managing your healthcare expenses effectively. If you have further questions or need personalized advice,don’t hesitate to reach out to your healthcare provider or insurance representative. You deserve to make the best decisions for your health and financial well-being. Thank you for reading!