Welcome to our extensive guide, ”Tax Free in Bangar – A Guide to Smart Savings.” In today’s fast-paced world, where financial pressures are an undeniable reality, understanding how to save effectively on taxes can make a significant difference in your economic well-being. this article aims to provide you with valuable insights on navigating the tax landscape in Bangar,empowering you with knowledge to maximize your savings.

Whether you’re a seasoned taxpayer or new to financial planning, our guide will walk you through various tax exemptions, deductions, and strategies that can definitely help you maintain more of your hard-earned money. We understand that tax regulations can often be overwhelming and confusing; our goal is to simplify these complexities and give you the confidence to make informed decisions. Join us on this journey toward smarter savings, as we unveil practical tips tailored to your specific needs, ensuring that you can take full advantage of the tax benefits available in Bangar. Let’s embark on this path to financial freedom together!

Understanding the Tax-Free Opportunities in Bangar for Everyday Savers

Bangar offers an array of tax-free opportunities that are notably beneficial for everyday savers looking to maximize their earnings without the burden of additional taxation. By understanding these financial avenues, you can navigate your savings journey more effectively. Here are some key options that residents and interested savers should consider:

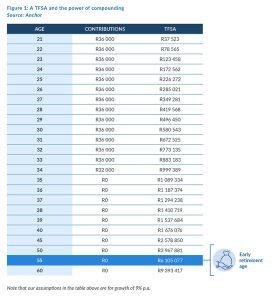

- Tax-Free savings Accounts (TFSAs): These accounts allow individuals to save and invest money without paying taxes on the returns. It’s an excellent way to build your savings while enjoying tax benefits.

- Government Bonds: Investing in certain government bonds issued in Bangar can yield tax-free interest, providing a low-risk investment opportunity that benefits savers.

- Retirement Accounts: Contributions to retirement accounts frequently enough come with tax benefits. Look for accounts with tax-free growth options, ensuring your future funds can grow without tax deductions.

- Local Savings Programs: Many local banks and credit institutions in Bangar offer special savings programs that are designed to encourage saving while providing tax exemptions on some interest earned.

To illustrate the benefits of these tax-free options, consider the following table that breaks down potential annual savings:

| Investment Type | Annual Return (%) | Taxable amount | Tax-Free amount |

|---|---|---|---|

| Tax-Free Savings Account | 3.00% | $0 | $1,500 |

| Government Bonds | 2.50% | $0 | $1,000 |

| Retirement Account | 5.00% | $300 | $1,700 |

By leveraging these opportunities, savers in Bangar can not only grow their wealth but also secure their financial futures without the worry of tax implications. As you explore these viable options, remember to evaluate your personal financial goals and choose the paths that align best with your savings strategies, ultimately making the most of your hard-earned money in Bangar.

Practical Strategies to Maximize Your Savings and Enjoy financial Freedom in Bangar

Embarking on a journey toward financial freedom in Bangar doesn’t have to be daunting. With a few practical strategies, you can gradually build a robust savings plan. Start by creating a budget that reflects your income and expenses accurately; tracking your spending helps identify where you can cut back and save more. Consider implementing the 50/30/20 rule—allocate 50% for needs, 30% for wants, and 20% for savings. Additionally, take advantage of local investment opportunities to grow your savings while enjoying tax-free benefits, which is a significant advantage in Bangar. Explore options such as:

- High-Interest Savings Accounts: look for accounts with the best interest rates offered by local banks.

- Fixed Deposits: Consider tying up your money for a fixed term to earn higher returns.

- Community Savings Groups: Join or form local groups that encourage saving and investing collectively.

Also, take advantage of common discounts and looked-for deals available through various businesses in Bangar, ensuring you keep an eye out for seasonal sales and local promotions. This approach can prevent unnecessary expenditures and direct more funds into your savings. For those who enjoy partaking in local culture, consider monetizing hobbies—like crafting or guiding local tours—bringing in extra income without the stress of a second job. The potential of small changes leading to significant savings cannot be underestimated. Remember,each rupee saved is a step closer to your financial independence,and adopting these strategies will not only enhance your savings but also align with the goal of enjoying a fulfilling life in Bangar.

navigating the ins and outs of tax-free opportunities in Bangar can significantly impact your financial well-being. By taking advantage of these smart savings strategies, you can better manage your finances and secure a brighter economic future. Whether you’re a local resident or new to the area, understanding these options empowers you to make informed decisions. Remember, financial literacy is a journey, and every step towards understanding tax benefits is a step towards a more stable and prosperous future. Happy saving!