Welcome to our complete guide on navigating the tax-free lifestyle in Tanki Leendert, a charming neighborhood that embodies the spirit of the Caribbean. For residents, understanding the nuances of local tax laws and benefits can greatly enhance your financial well-being and contribute to a more fulfilling life in this vibrant community.Whether you’re a long-time resident or new to the area, we’ll provide you with essential information on tax exemptions, local regulations, and practical tips to make the most of your tax-free status. Living in Tanki Leendert offers unique opportunities, and with the right knowledge, you can fully embrace the advantages that come with it. Join us as we explore the ins and outs of living tax-free, ensuring you remain informed and empowered to make the best decisions for you and your family.

understanding Tax Exemptions available for Residents in Tanki Leendert

residents of Tanki Leendert enjoy a range of tax exemptions,tailored specifically to alleviate the financial burden on individuals and families. Understanding these exemptions can empower you to make the most out of your finances while living in this vibrant area. Below are some of the key exemptions you might benefit from:

- Property Tax Exemptions: Many residents are eligible for reductions in property taxes, especially if they occupy their primary residence.

- Income Tax Exemptions: Certain qualifying income brackets may find relief from local income taxes, designed to support low and middle-income families.

- Education Tax Credits: Parents of school-aged children can qualify for educational tax credits that offset tuition costs,providing meaningful savings.

- Seniors and Disabled Exemptions: Special provisions are in place for seniors and disabled residents, allowing for reduced rates or complete exemptions on various taxes.

- Charitable Contributions: Donations to registered local charities can frequently enough lead to tax deductions, promoting community support.

It’s significant to stay informed and proactive about these exemptions. For a more structured overview, here’s a rapid reference table of commonly applicable tax exemptions:

| Type of Exemption | Description | Eligibility Criteria |

|---|---|---|

| Property Tax | Reduction on primary residence taxes | owner-occupied homes |

| Income Tax | Exemptions based on income levels | Low to middle-income households |

| Education Credit | Credits for tuition expenses | Based on school enrollment |

| Seniors/Disabled | Exemptions or reductions for seniors and disabled | Aged individuals or certified disabilities |

| Charitable Donations | Deductions for community support | Donations to local charities |

Continuously refer to local resources or financial advisors in Tanki Leendert to ensure you are maximizing these offerings while contributing positively to your community. By navigating these exemptions wisely, you can enhance your living experience in this gorgeous area, making it all the more enjoyable and manageable.

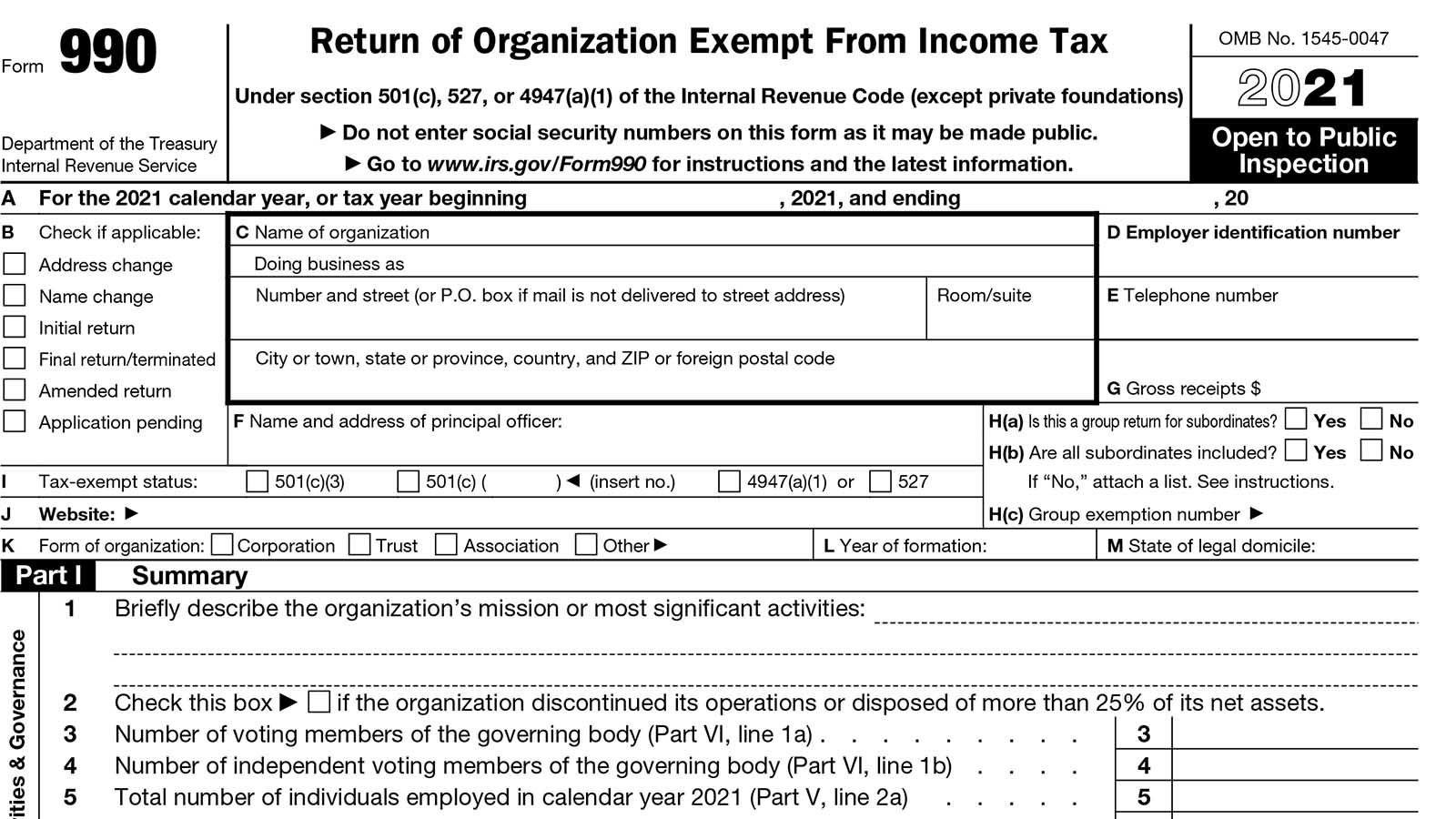

Navigating the Application Process for Tax Benefits and Incentives in Tanki leendert

Understanding how to access tax benefits and incentives in Tanki Leendert can be daunting but navigating the process can be a significant step towards financial relief. As a resident, it’s essential to familiarize yourself with the local regulations and available programs designed to assist you. Start by gathering the necesary documents, including:

- Identification documents - ensure that you have valid identification and proof of residency.

- Income statements – collect recent income statements or tax records to substantiate your application.

- Proof of expenses – Document any relevant expenses that may qualify for deductions.

Once you have compiled your documents, visit the local tax office or their official website to access the guidelines for application. They ofen provide detailed steps to follow, including:

- Filling out required forms - Ensure that all forms are completed accurately to avoid delays.

- Consulting with tax professionals - Sometimes,getting expert insights can make the process smoother.

- Online submissions – Explore if you can submit applications digitally; this has become increasingly common and user-pleasant.

Remember, patience is key. It may take time to process your application, so stay informed about its progress through available tracking tools or by directly contacting the office. Just like in travel, having a roadmap makes your journey easier and much more enjoyable. For those looking to experience life in Tanki Leendert, understanding these tax benefits not onyl enhances your budget but also maximizes your time for leisure activities, making your stay even more delightful.

navigating the tax benefits available to residents of Tanki Leendert can significantly enhance your financial well-being. By taking advantage of the community’s tax-free initiatives, you can enjoy improved savings and a more agreeable lifestyle. We hope this guide has provided you with valuable insights and practical steps to maximize these opportunities. Remember, staying informed is key to making the most of the resources available to you as a resident.Feel free to reach out for further clarification or assistance as you embark on this journey towards a tax-efficient life in Tanki Leendert.